BeMetals Commences Surface Drilling Program at High-Grade South Mountain Zinc-Silver-Gold-Copper Project in Idaho

October 18, 2021

Vancouver, British Columbia – BeMetals Corp. (TSXV: BMET, OTCQB: BMTLF, Frankfurt: 1OI.F) (the “Company” or “BeMetals”) is pleased to announce the start of an exploratory phase of drilling from surface at its high-grade South Mountain Zinc-Silver-Gold-Copper Project (“South Mountain” or the “Project” or the “Property”) in southwest Idaho, U.S.A. This program is designed to further test the down depth extent of mineralization at the DMEA Zone with the objective to significantly expand the scale of the current Mineral Resource Estimate (“MRE”) at South Mountain (See Summary below and Table 1). The DMEA Zone is the largest known body of mineralization on the Property, containing the majority of tonnage in the current MRE, and the mineralized zone remains open at depth.

John Wilton, President and CEO of BeMetals stated, “Based on our last two phases of underground drilling and all the historical exploration data available, we are confident that there is strong potential to substantially increase the mineral resources with this new phase of surface drilling at the Property. We plan to complete approximately 2,100 metres of surface core drilling in this phase of exploration work. Assuming this exploration program is successful, our plan is to update the current MRE and complete an ongoing Preliminary Economic Assessment for the Project in 2022.”

Since optioning the South Mountain Project in early 2019, BeMetals has conducted two phases of underground core drilling at the Property for a combined total of approximately 5,000 metres. All of the drilling results from the Company’s past programs have been incorporated into the current MRE for the South Mountain deposit and filed on SEDAR in June 2021. The 2021 MRE is summarised as:

Measured & Indicated (“M&I”): 187,650 tonnes grading 9.63% Zinc (“Zn”), 151 grams per tonne (“g/t”) Silver (“Ag”), 2.19 g/t Gold (“Au”), 1.01% Lead (“Pb”) and 0.63% Copper (“Cu”). This represented a 21.8% increase to the M&I tonnage from the historical 2019 MRE with a 20.36% Zn equivalent grade (“ZnEq”).

Inferred: 756,300 tonnes grading 7.63% Zn, 196 g/t Ag, 1.40 g/t Au, 0.97% Pb and 0.81% Cu. This represented a 129.5% increase in the Inferred tonnage from the historical 2019 MRE with a 18.10% ZnEq grade.

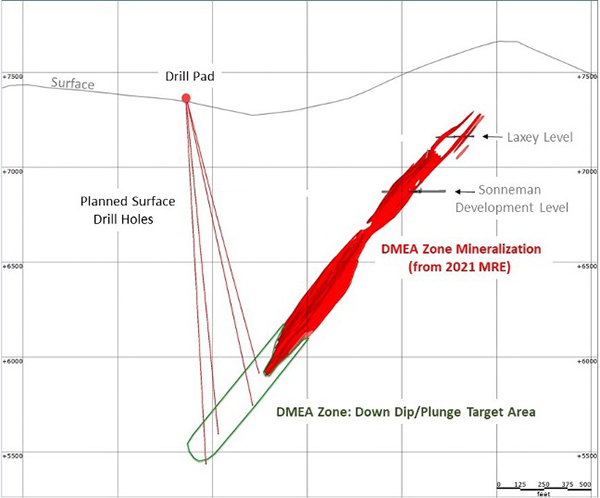

During the first week of October, a surface drilling rig was mobilized to the Property. See Figure 1 below for a cross section view of the existing DMEA Zone mineralization and the planned drill target area. The drill target area remains subject to modification with the incorporation of ongoing drilling results.

Figure 1. Simplified Cross Section Through South Mountaion Deposit, DMEA Zone and Planned Surface Drilling Exploration Holes (Looking to northwest)

Table 1. South Mountain Mineral Resource Statement (Metric Units)

| Grades and Contained Metal | |||||||||||||||

| Ore Type | Classification | Mass | Zinc | Zinc | Silver | Silver | Gold | Gold | Lead | Lead | Copper | Copper | ZnEq | ||

| Kt | % | t | ppm | kg | ppm | g | % | t | % | t | % | ||||

| Massive Sulfide | Measured | 48.85 | 11.45 | 5,600 | 126 | 6,100 | 2.38 | 116,200 | 0.79 | 400.00 | 0.46 | 200 | 20.21 | ||

| Indicated | 107.90 | 11.36 | 12,300.0 | 164 | 17,700 | 2.63 | 283,500 | 1.36 | 1,500 | 0.53 | 600 | 22.14 | |||

| Measured + Indicated | 156.75 | 11.39 | 17,800.0 | 152 | 23,800 | 2.55 | 399,700 | 1.18 | 1,900 | 0.51 | 800 | 21.54 | |||

| Inferred | 705.03 | 8.09 | 57,000.0 | 202 | 142,600 | 1.49 | 1,049,000 | 1.04 | 7,300 | 0.74 | 5,200 | 18.34 | |||

| Skarn | Measured | 9.62 | 1.25 | 100.0 | 187 | 1,800 | 0.78 | 7,500 | 0.30 | 0 | 1.26 | 100 | 18.23 | ||

| Indicated | 21.28 | 0.49 | 100.0 | 130 | 2,800 | 0.17 | 3,700 | 0.07 | 0 | 1.20 | 300 | 12.63 | |||

| Measured + Indicated | 30.90 | 0.72 | 200.0 | 148 | 4,600 | 0.36 | 11,200 | 0.14 | 0 | 1.21 | 400 | 14.38 | |||

| Inferred | 51.26 | 1.34 | 700.0 | 110 | 5,600 | 0.19 | 9,900 | 0.04 | 0 | 1.66 | 900 | 14.92 | |||

| Total | Measured | 58.47 | 9.77 | 5,700.0 | 136 | 7,900 | 2.12 | 123,700 | 0.71 | 400 | 0.59 | 300 | 19.88 | ||

| Indicated | 129.18 | 9.57 | 12,400.0 | 158 | 20,400 | 2.22 | 287,300 | 1.15 | 1,500 | 0.64 | 800 | 20.57 | |||

| Measured + Indicated | 187.65 | 9.63 | 18,100.0 | 151 | 28,400 | 2.19 | 411,000 | 1.01 | 1,900 | 0.63 | 1,200 | 20.36 | |||

| Inferred | 756.30 | 7.63 | 57,700.0 | 196 | 148,200 | 1.40 | 1,058,900 | 0.97 | 7,300 | 0.81 | 6,100 | 18.10 | |||

- The effective date of the mineral resource estimate is April 20th, 2021. The QP for the estimate is Mr. Richard A. Schwering, P.G., SME-RM, of Hard Rock Consulting, LLC. and is independent of BeMetals, Corp., Thunder Mountain Gold Inc., and South Mountain Mines Inc.

- Mineral resources are not mineral reserves and do not have demonstrated economic viability such as diluting materials and allowances for losses that may occur when material is mined or extracted; or modifying factors including but not restricted to mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social and governmental factors. Inferred mineral resources may not be converted to mineral reserves. It is reasonably expected, though not guaranteed, that the majority of Inferred mineral resources could be upgraded to Indicated mineral resources with continued exploration.

- The mineral resource is reported at an underground mining cutoff of $102.50/ton U.S. Net Smelter Return (“NSR”) within coherent wireframe models. The NSR calculation and cut-off is based on the following assumptions: an Au price of $1,750/oz, Ag price of $23.00/oz, Pb price of $1.02/lb., Zn price of $1.20/lb. and Cu price of $3.40/lb.; Massive sulfide ore type metallurgical recoveries and payables of 52.25% for Au, 71.25% for Ag, 71.40% for Zn, 66.50% for Pb, and 49.00% for Cu and a total smelter cost of $33.29/ton; Skarn ore type metallurgical recoveries and payables of 71.25% for Au, 80.75% for Ag, 51.00% for Zn, 47.50% for Pb, and 87.70% for Cu and a smelter cost of $7.24/ton; assumed mining cost of $70/ton, process costs of $25/ton, and general and administrative costs of $7.50/ton. Based on the stated prices and recoveries the NSR formula is calculated as follows; NSR = (Ag grade * Ag price * Ag Recovery and Payable) + (Au grade * Au price * Au Recovery and Payable) + (Pb grade * 20 * Pb Price * Pb Recovery and Payable) + (Cu grade * 20 * Cu Price * Cu Recovery and Payable) + (Zn grade * 20 * Zn Price * Zn Recovery and Payable)-(smelter charges) for each ore type.

- The zinc equivalent grades were calculated as Zn Grade + (((Pb Price * Pb Recovery and Payable) / (Zn Price*Zn Recovery and Payable)) * Pb Grade) + (((Cu Price * Cu Recovery and Payable) / (Zn Price * Zn Recovery and Payable)) * Cu Grade) + (((Ag Price * Ag Recovery and Payable) / (Zn Price * 20 * Zn Recovery and Payable)) * Ag Grade) + (((Au Price * Au Recovery and Payable) / (Zn Price * 20 * Zn Recovery and Payable)) * Au Grade)

- Rounding may result in apparent differences when summing tons, grade and contained metal content. Tonnage and grade measurements are in U.S. units and converted to metric.

- HRC estimated the mineral resources based on drillhole and channel sample data constrained by geologic boundaries using an Ordinary Kriging algorithm.

- Measured mineral resources are those DMEA and Texas Zone blocks within 40ft of the Sonneman level. Indicated mineral resources are those DMEA and Texas Zone blocks within 100 ft of the Sonneman level and 40 ft of the Laxey level.

ABOUT THE SOUTH MOUNTAIN PROJECT

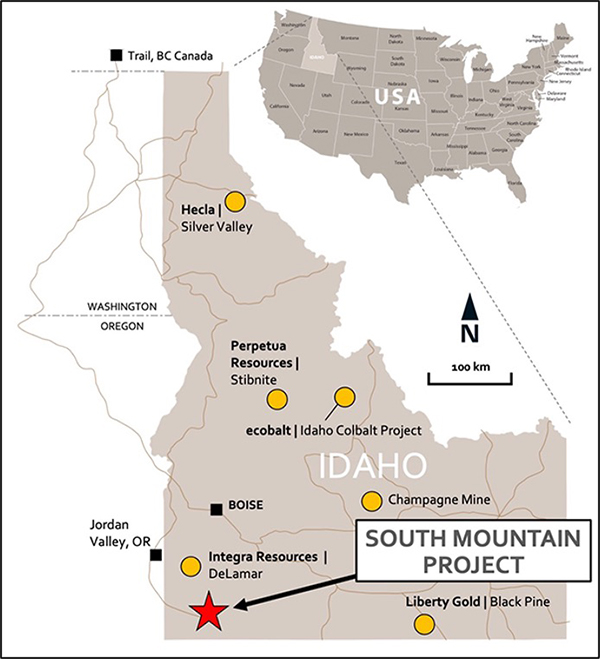

South Mountain is a polymetallic development project focused on high-grade zinc and is located approximately 70 miles southwest of Boise, Idaho (See Figure 2). The Project was intermittently mined from the late 1800s to the late 1960s and its existing underground workings remain intact and well maintained. Historic production at the Project has largely come from high-grade massive sulphide bodies that remain open at depth and along strike. According to historical smelter records, approximately 53,642 tons of mineralized material has been mined to date. These records also indicate average grades; 14.5% Zn, 363.42 g/t Ag, 1.98 g/t Au, 2.4% Pb, and 1.4% Cu were realised (See NI 43-101 Technical Report: Updated Mineral Resource Estimate for the South Mountain Project, dated June 15, 2021, Section 6.4 – Table 6.3 for more details. Available on the BeMetals website and at www.sedar.com). Thunder Mountain purchased and advanced the South Mountain from 2007 through 2019, with expenditures into the Project of approximately US$12million.

BeMetals formed a Boise, Idaho-based project team that is focused on advancing South Mountain. This team includes key management of Thunder Mountain, Optionee of the Property. The Project team has completed re-establishment of the Project site and have conducted two phases of drilling. The team continues to build and maintain strong relations with local communities relevant to the South Mountain Project. The Project is largely on and surrounded by private surface land, and as such, the permitting and environmental aspects of the Project are expected to be straightforward. Permits are in place for underground exploration activities and BeMetals does not anticipate significant barriers to any future development at the Project.

Figure 2: Project Location Map

ABOUT BEMETALS CORP.

BeMetals is a precious and base metals exploration and development company focused on becoming a leading metal producer through the acquisition of quality exploration, development and potentially production stage projects. The Company has recently established itself in the gold sector with the acquisition of certain wholly owned exploration projects in Japan. BeMetals is also progressing both its advanced high-grade, zinc-silver-gold-copper polymetallic underground exploration at the South Mountain Project in Idaho through a preliminary economic assessment, and its tier-one targeted, Pangeni Copper Exploration Project in Zambia. Guiding and leading BeMetals’ growth strategy is a strong board and management team, founders and significant shareholders of the Company, who have an extensive proven record of delivering considerable value in the mining sector through the discovery, construction and operation of mines around the world.

qualified person statement for the mineral resource estimate

Mr. Richard A. Schwering, P.G., SME-RM, a Resource Geologist with Hard Rock Consulting, LLC, is responsible for the South Mountain Project Mineral Resource Estimate with an effective date of April 20, 2021. Mr. Schwering is a Qualified Person as defined by NI43-101 and is independent of BeMetals Corp., Thunder Mountain Mines Inc., and South Mountain Mines, Inc. Mr. Schwering estimated the mineral resources based on drill hole and channel sample data constrained by geologic boundaries using an Ordinary Krige algorithm. The Geologic Model and Mineral Resource Estimate were completed using Leapfrog Geo® Software version 6.0.5.

The technical information in this news release for BeMetals has been reviewed and approved by John Wilton, CGeol FGS, CEO and President of BeMetals, and a “Qualified Person” as defined under National Instrument 43-101.1

ON BEHALF OF BEMETALS CORP.

“John Wilton”

John Wilton

President, CEO and Director

For further information about BeMetals please visit our website at bemetalscorp.com and sign-up to our email list to receive timely updates, or contact:

Derek Iwanaka

Vice President, Investor Relations & Corporate Development

Telephone: 604-609-6141

Email: diwanaka@bemetalscorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release

Cautionary Note Regarding Forward-Looking Statements

This news release contains "forward-looking statements" and “forward looking information” (as defined under applicable securities laws), based on management’s best estimates, assumptions and current expectations. Such statements include but are not limited to, statements with respect to future exploration, development and advancement of the South Mountain Project, the Pangeni project and the Japan properties, and the acquisition of additional base and/or precious metal projects. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as "expects", "expected", "budgeted", "forecasts", "anticipates", "plans", "anticipates", "believes", "intends", "estimates", "projects", "aims", "potential", "goal", "objective", "prospective", and similar expressions, or that events or conditions "will", "would", "may", "can", "could" or "should" occur. These statements should not be read as guarantees of future performance or results. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from those expressed or implied by such statements, including but not limited to: the actual results of exploration activities, the availability of financing and/or cash flow to fund the current and future plans and expenditures, the ability of the Company to satisfy the conditions of the option agreements for the South Mountain Project and/or the Pangeni Project, and changes in the world commodity markets or equity markets. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The forward-looking statements and forward looking information are made as of the date hereof and are qualified in their entirety by this cautionary statement. The Company disclaims any obligation to revise or update any such factors or to publicly announce the result of any revisions to any forward-looking statements or forward looking information contained herein to reflect future results, events or developments, except as require by law. Accordingly, readers should not place undue reliance on forward-looking statements and information. Please refer to the Company’s most recent filings under its profile at www.sedar.com for further information respecting the risks affecting the Company and its business.