BeMetals Generates Priority Drill Targets at the Tashiro Gold Project, Kyushu, Japan

April 18, 2023

Vancouver, British Columbia – BeMetals Corp. (TSXV: BMET, OTCQB: BMTLF, Frankfurt: 1OI.F) (the “Company” or “BeMetals”) is pleased to announce it has integrated recently received drone magnetic survey information with historical drill results that has generated several compelling drill targets at the Tashiro Gold Project (“Tashiro” or the “Project”) in Kyushu. These new drill targets focus on testing and potentially extending at least two significant zones of vein-hosted gold mineralization at the Noya and Noya Southwest (“Noya SW”) prospects on the Tashiro property.

Highlights of TASHIRO PROJECT DRILL TARGETS:

Noya Prospect

- Recently completed high-resolution drone magnetic survey both maps and extends target zone at Noya

prospect - Historical results reported from drilling in 1990s indicate a high-grade epithermal gold vein zone

- Gold mineralization target has a strike extent of over 1.5 kilometres, and includes the following selected

historical drill intersections:

- 4MAKC-1: 63.90 grams per tonne (“g/t”) gold (“Au”) & 16.70 g/t silver (“Ag”) over 0.47m

- 4MAKC-4: 28.60 g/t Au & 12.90 g/t Ag over 1.08m

- 7MAKN-4: 41.60 g/t Au & 28.40 g/t Ag over 0.30m

Noya SW Prospect

- 9MAKN-7: 1.67 g/t Au & 1.70 g/t Ag over 27.10m, Including: 3.38 g/t Au over 8.95m

- 9MAKN-8: 13.80 g/t Au & 16.70 g/t Ag over 1.30m

Note: Table 1 below provides details of these intersections, and Table 2 the other historical drill intersections within the Tashiro Project

John Wilton, President and CEO of BeMetals stated, “We are delighted with the interpretation of our recently completed airborne drone magnetic survey when combined with the historical drilling data at our Tashiro Project. The Tashiro property is located within the Northern Kyushu epithermal gold province. Importantly, certain features of this new magnetic data are consistent with the orientation of the main Noya prospect gold vein trend. Additionally, signatures in this data indicate the potential extension of this gold vein target zone to some 1.5 kilometres along strike."

Furthermore, on a recent field reconnaissance to the Tashiro Project area, Dr. Richard Sillitoe, world renowned economic geologist, and technical advisor to the Company, noted “Further drill testing of the Noya and Noya SW veins is clearly merited. The historical high-grade vein intersections are at vertical depths of approximately 175 to 200 metres below surface, thereby defining a clear initial depth target for the planned drilling.”

John Wilton concluded, “The Company intends to schedule drill testing of the Tashiro Project later in the year after it has completed the current and planned phases of drilling at its Kato and Todoroki projects in Hokkaido, Japan.”

TASHIRO GOLD PROJECT

The Tashiro Project is located in Oita Prefecture of central northeastern Kyushu (Figure 1). The Project is situated within the regional scale Hohi Graben, a major geological structure in this district that is associated with numerous historical gold mines and prospects known collectively as the Northern Kyushu epithermal gold province.

Figure 1: Location Map of Tashiro Gold Project, Kyushu, Japan

The high-grade quartz-gold veins of the Noya and Noya SW prospects within the Tashiro Project do not crop out. This area was initially explored for its geothermal energy potential with a single drill hole completed in 1952, and subsequently three more holes were completed in 1977. The existence of epithermal quartz-gold veins in this drill core, with associated intense alteration, was first recognised by Morishita & Takeno and reported in 19891. Motivated by these reported observations and the detection of gold in assays for some of the drilled veins, the Metal Mining Agency of Japan (“MMAJ”), a Japanese state agency, conducted exploration at the Noya and Noya SW prospects (the “Prospects”) between 1989 and 1994.

The drilling completed by MMAJ confirmed the development of an extensive epithermal gold system at the Prospects, with many of the hallmarks of such mineralization, such as typical quartz textures and associated trace elements.

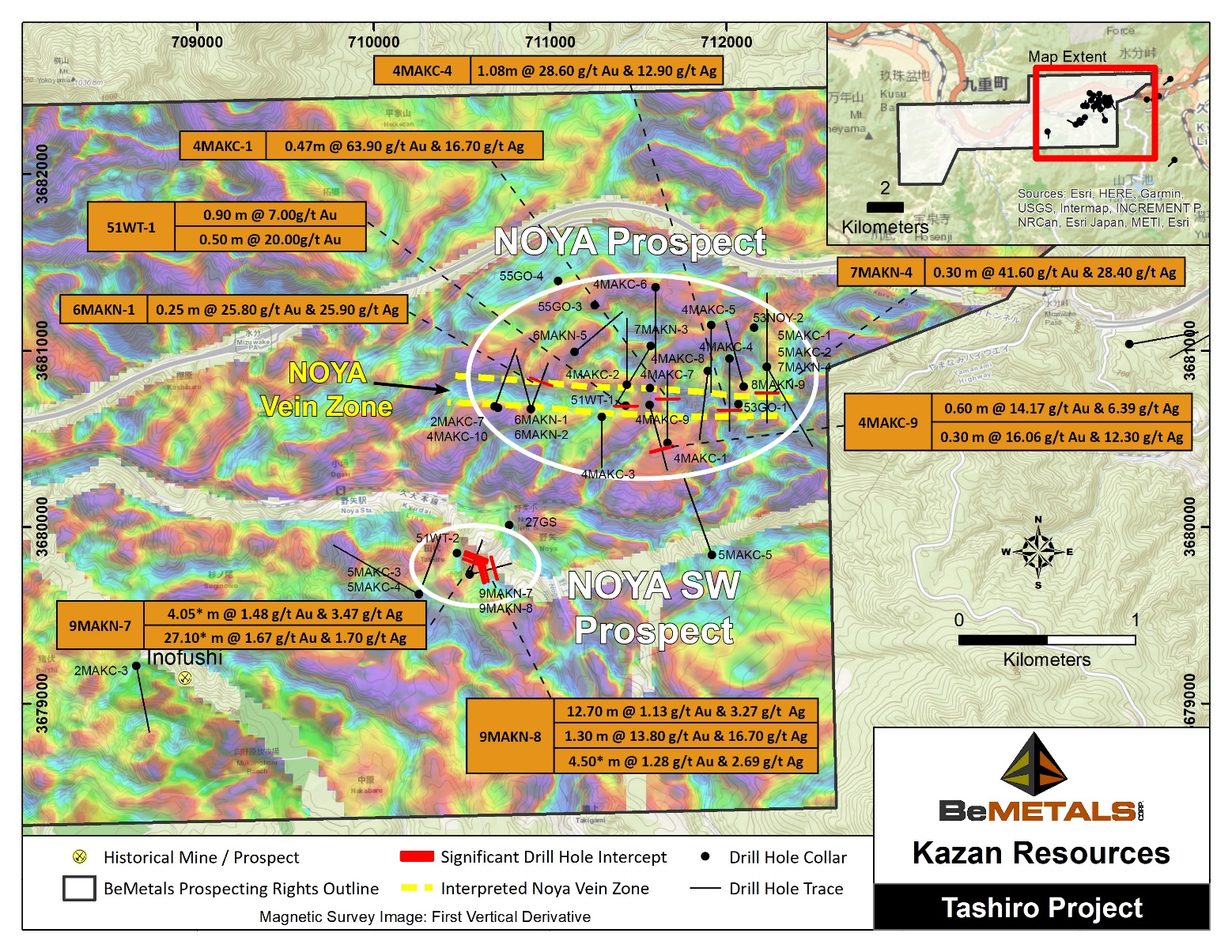

Figure 2 below illustrates the location of MMAJ’s drill holes and the interpreted approximate east-west strike of the Noya vein zone. This main Noya vein zone trend appears to be mapped by a coincident east-west oriented, magnetic low signature, interpreted to be related to an important controlling structural trend. The Company is intending to complete three to four drillholes to test the Noya and Noya SW prospects.

Figure 2. Drone Magnetic Data with Selected Historical Drill Intersections, Tashiro Gold Project, Kyushu, Japan

Table 1 below includes the details of the selected MMAJ drill intersections, associated with the main Noya vein zone, and the Noya SW prospects, with drilled widths and gold and silver grades. This series of relatively shallow depth below surface (approximately 175-200m), generally high-grade, gold intersections demonstrate the potential of this epithermal system to generate significant gold grades. This is an encouraging characteristic of these Prospects, motivating the future exploration drilling of the project.

Table 2 provides the gold and silver intersection results of all the remaining historical drill intersections at these two Prospects within the Tashiro Project area. These addition results demonstrate that even outside the initial targets of the main Noya vein zone and Noya SW prospects there is an extensive footprint to the gold mineralization.

Table 3 details of all the historical drill hole locations with; azimuth, dip, end of hole depth and collar coordinate information.

Table 1: Historical Selected Drill Hole Intersection Results

| Drill hole and Interval |

From (m) |

To (m) |

Core Interval (m) |

Au g/t |

Ag g/t |

| Noya | |||||

| 4MAKC-1 | 306.90 | 307.37 | 0.47 | 63.90 | 16.70 |

| 4MAKC-4 | 353.98 | 355.06 | 1.08 | 28.60 | 12.90 |

| 4MAKC-9 | 335.55 | 336.15 | 0.60 | 14.17 | 6.39 |

| 339.55 | 339.85 | 0.30 | 16.06 | 12.30 | |

| 51WT-1 | 164.20 | 165.10 | 0.90 | 7.00 | NA |

| 201.00 | 201.50 | 0.50 | 20.00 | NA | |

| 6MAKN-1 | 234.65 | 234.90 | 0.25 | 25.80 | 25.90 |

| 7MAKN-4 | 205.80 | 206.10 | 0.30 | 41.60 | 28.40 |

| Noya SW | |||||

| 9MAKN-7 | 90.50 | 95.05 | 4.05* | 1.48 | 3.47 |

| 121.30 | 148.40 | 27.10* | 1.67 | 1.70 | |

| Including: | 121.30 | 127.10 | 5.80 | 1.27 | 1.48 |

| Including: | 139.45 | 148.40 | 8.95 | 3.38 | 3.00 |

| 9MAKN-8 | 84.50 | 97.20 | 12.70* | 1.13 | 3.27 |

| 119.60 | 120.90 | 1.30 | 13.80 | 16.70 | |

| 184.40 | 188.90 | 4.50* | 1.28 | 2.69 |

Table 1 Notes: These drill results are historical in nature. BeMetals has not undertaken any independent investigation of the sampling, nor has it independently analyzed the results of the historical exploration work in order to verify the results. BeMetals considers these historical drill results relevant as the Company will use this data as a guide to plan future exploration programs. The Company also considers the data to be reliable for these purposes however, the Company's future exploration work will include verification of the data through drilling. The reported results are drilled intersection widths as the orientation of the mineralized zones and their true thickness is currently not known. Intersections relate to individual samples, except for Noya SW prospect where composites* where calculated using a nominal cut-off grade of 0.5 g/t Au, with a maximum of 2.55 metres of internal dilution, to determine the boundaries of the intersections.

Table 2: Other Historical Drill Hole Intersection Results

| Drill hole and Interval |

From (m) |

To (m) |

Core Interval (m) |

Au g/t |

Ag g/t |

| 2MAKC-7 | 242.00 | 242.40 | 0.40 | 5.75 | 2.30 |

| 4MAKC-6 | 320.40 | 320.80 | 0.40 | 4.86 | 11.30 |

| 4MAKC-10 | 186.95 | 188.35 | 1.40 | 5.04 | 5.84 |

| 4MAKC-10 | 190.30 | 190.55 | 0.25 | 4.38 | 4.32 |

| 5MAKC-1 | 396.20 | 396.83 | 0.63 | 3.92 | 1.85 |

| 5MAKC-2 | 242.20 | 242.67 | 0.47 | 3.43 | 4.36 |

| 6MAKN-1 | 175.95 | 176.30 | 0.35 | 5.99 | 2.87 |

| 6MAKN-1 | 180.70 | 180.98 | 0.28 | 8.52 | 9.67 |

| 8MAKN-5 | 407.45 | 407.90 | 0.45 | 3.59 | 0.82 |

| 8MAKN-6 | 157.55 | 157.85 | 0.30 | 6.32 | 4.28 |

| Drill holes: 53GO-1,3,4, 53NOY-2 & 27GS were geothermal holes not sampled for gold | |||||

| Drill holes: 4MAKC-2,3,5,7,8, 5MAKC-5, 6MAKN-2, 7MAKN-3, 51WT-2, 2MAKC-3,6, & 5MAKC-3,4 were reported as not returning any significant sampled gold mineralization | |||||

Table 2 Notes: These drill results are historical in nature. BeMetals has not undertaken any independent investigation of the sampling, nor has it independently analyzed the results of the historical exploration work in order to verify the results. BeMetals considers these historical drill results relevant as the Company will use this data as a guide to plan future exploration programs. The Company also considers the data to be reliable for these purposes however, the Company's future exploration work will include verification of the data through drilling. The reported results are drilled intersection widths as the orientation of the mineralized zones and their true thickness is currently not known. Intersections relate to individual samples.

Table 3: Historical Drill Hole ID, Azimuth, Dip, End of Hole Depth and Collar Coordinates

| Drill Hole ID | Azimuth Degree |

Dip Degree | End of hole Depth (m) |

Easting (m) |

Northing (m) |

Elevation (m) |

| 53GO-1 | 0 | -90 | 700 | 712068 | 3680695 | 620 |

| 55GO-3 | 0 | -90 | 1085 | 711253 | 3681255 | 670 |

| 55GO-4 | 0 | -90 | 510 | 711046 | 3681393 | 665 |

| 53NOY-2 | 0 | -90 | 762 | 712156 | 3681128 | 650 |

| 2MAKC-7 | 0 | -90 | 600 | 710706 | 3680674 | 650 |

| 4MAKC-1 | 360 | -35 | 500 | 711666 | 3680474 | 670 |

| 4MAKC-2 | 360 | -40 | 500 | 711435 | 3680805 | 640 |

| 4MAKC-3 | 180 | -55 | 500 | 711294 | 3680623 | 660 |

| 4MAKC-4 | 180 | -35 | 500 | 712016 | 3680952 | 660 |

| 4MAKC-5 | 180 | -40 | 500 | 711915 | 3681144 | 685 |

| 4MAKC-6 | 180 | -30 | 500 | 711599 | 3681358 | 675 |

| 4MAKC-7 | 0 | -90 | 500 | 711566 | 3680787 | 675 |

| 4MAKC-8 | 187 | -38 | 500 | 711895 | 3680884 | 620 |

| 4MAKC-9 | 165 | -40 | 500 | 711565 | 3680690 | 670 |

| 4MAKC-10 | 20 | -45 | 500 | 710687 | 3680682 | 620 |

| 5MAKC-1 | 150 | -30 | 601 | 712228 | 3680906 | 620 |

| 5MAKC-2 | 360 | -40 | 550 | 712228 | 3680906 | 590 |

| 5MAKC-5 | 340 | -35 | 600 | 711919 | 3679839 | 655 |

| 6MAKN-2 | 345 | -45 | 451 | 710891 | 3680667 | 600 |

| 7MAKN-3 | 211 | -40 | 504 | 711570 | 3681024 | 630 |

| 8MAKN-5 | 50 | -40 | 468 | 711139 | 3680990 | 670 |

| 8MAKN-6 | 345 | -30 | 450 | 712098 | 3680795 | 615 |

| 27GS | 0 | -90 | 132 | 710770 | 3680008 | 550 |

| 51WT-1 | 360 | -90 | 700 | 711429 | 3680685 | 660 |

| 51WT-2 | 0 | -90 | 700 | 710474 | 3679851 | 585 |

| 2MAKC-3 | 169 | -40 | 500 | 708655 | 3679210 | 540 |

| 2MAKC-6 | 0 | -90 | 500 | 702895 | 3675026 | 510 |

| 5MAKC-3 | 300 | -20 | 600 | 710258 | 3679618 | 590 |

| 5MAKC-4 | 20 | -45 | 501 | 710258 | 3679618 | 600 |

| 6MAKN-1 | 020 | -45 | 400 | 710891 | 3680666 | 650 |

| 7MAKN-4 | 180 | -45 | 450 | 712228 | 3680906 | 600 |

| 9MAKN-7 | 020 | -40 | 275 | 710544 | 3679730 | 580 |

| 9MAKN-8 | 075 | -40 | 325 | 710544 | 3679730 | 580 |

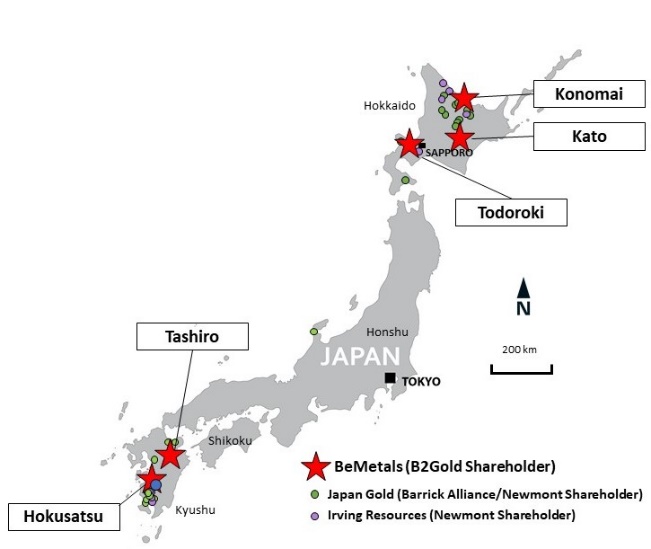

The Company is currently exploring its highly prospective portfolio of five gold exploration projects in Japan. As exploration work and surveys over the entire BeMetals’ portfolio of projects is advanced, the high quality and discovery potential of all of these projects becomes increasingly evident. The location of the projects is illustrated in Figure 3 below.

Figure 3. Location of BeMetals Kazan Gold Projects in Japan

QUALITY ASSURANCE AND QUALITY CONTROL

These drill results are historical in nature. BeMetals has not undertaken any independent investigation of the sampling, nor has it independently analyzed the results of the historical exploration work in order to verify the results. BeMetals considers these historical drill results relevant as the Company will use this data as a guide to plan future exploration programs. The Company also considers the data to be reliable for these purposes, however the Company's future exploration work at the Tashiro Project will include verification of the historical data through drilling.

REFERENCE

- Morishita, Y. and Takeno, N. (1989) Gold mineralization in the Noya geothermal area, Ohita prefecture. Mining Geol., 39, 68.

ABOUT BEMETALS CORP.

BeMetals is a precious and base metals exploration and development company focused on becoming a leading metal producer through the acquisition of quality exploration, development and potentially production stage projects. The Company has established itself in the gold sector with the acquisition of a portfolio of wholly owned exploration projects in Japan. BeMetals is also progressing its tier-one targeted, Pangeni Copper Exploration Project in the prolific Zambian Copperbelt with co-funding investor the Japanese state agency JOGMEC (“Japan Organization for Metals and Energy Security”). Guiding and leading BeMetals’ growth strategy is a strong board and management team, founders and significant shareholders of the Company, who have an extensive proven record of delivering exceptional value in the mining sector, over many decades, through the discovery, construction and operation of mines around the world.

QUALIFIED PERSON STATEMENT

The technical information in this news release for BeMetals has been reviewed and approved by John Wilton, CGeol FGS, CEO and President of BeMetals, and a “Qualified Person” as defined under National Instrument 43-101.

ON BEHALF OF BEMETALS CORP.

“John Wilton”

John Wilton

President, CEO and Director

For further information about BeMetals please visit our website at bemetalscorp.com and sign-up to our email list to receive timely updates, or contact:

Derek Iwanaka

Vice President, Investor Relations & Corporate Development

Telephone: 604-928-2797

Email: diwanaka@bemetalscorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release

Cautionary Note Regarding Forward-Looking Statements

This news release contains "forward-looking statements" and “forward looking information” (as defined under applicable securities laws), based on management’s best estimates, assumptions and current expectations. Such statements include but are not limited to, statements with respect to future exploration, development and advancement of the Kazan Projects in Japan and the Pangeni Project in Zambia, and the acquisition of additional base and/or precious metal projects. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as "expects", "expected", "budgeted", "forecasts", "anticipates", "plans", "anticipates", "believes", "intends", "estimates", "projects", "aims", "potential", "goal", "objective", "prospective", and similar expressions, or that events or conditions "will", "would", "may", "can", "could" or "should" occur. These statements should not be read as guarantees of future performance or results. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from those expressed or implied by such statements, including but not limited to: the actual results of exploration activities, the availability of financing and/or cash flow to fund the current and future plans and expenditures, the ability of the Company to satisfy the conditions of the option agreement for the Pangeni Project, and changes in the world commodity markets or equity markets. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The forward-looking statements and forward looking information are made as of the date hereof and are qualified in their entirety by this cautionary statement. The Company disclaims any obligation to revise or update any such factors or to publicly announce the result of any revisions to any forward-looking statements or forward looking information contained herein to reflect future results, events or developments, except as require by law. Accordingly, readers should not place undue reliance on forward-looking statements and information. Please refer to the Company’s most recent filings under its profile at www.sedar.com for further information respecting the risks affecting the Company and its business.