BeMetals Drilling Results Exceed Expectations at the High-Grade Base and Precious Metal South Mountain Project in Idaho

November 26, 2019

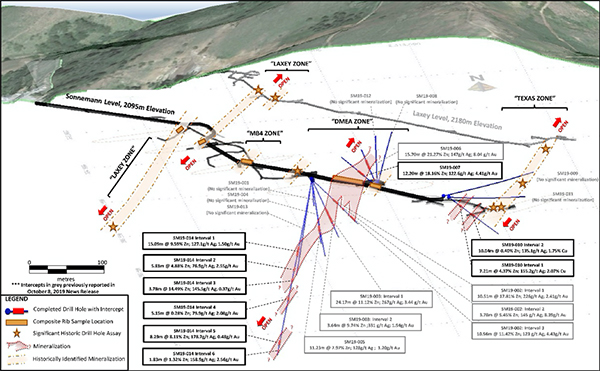

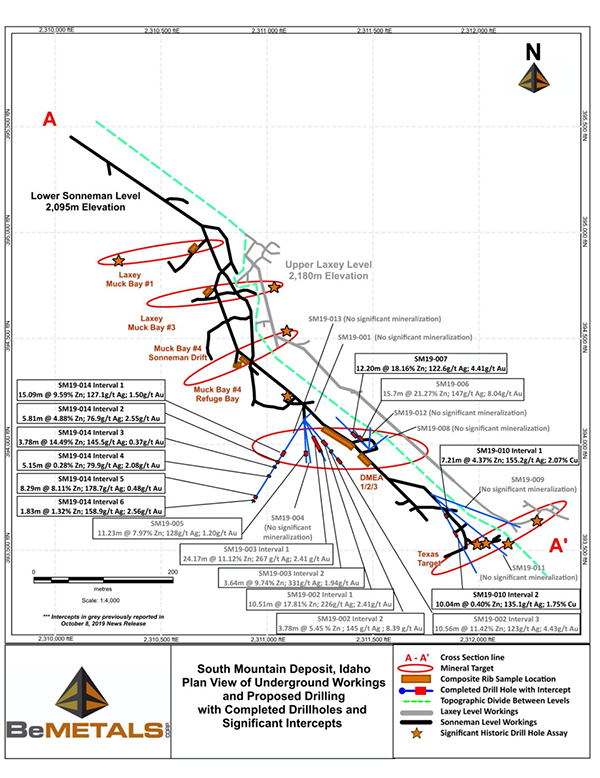

VANCOUVER, CANADA - BeMetals Corp. (“BeMetals” or the “Company”) (TSXV: BMET and OTCQB: BMTLF) is pleased to announce analytical results for drill holes SM19-007, SM19-010 and SM19-014 from its Phase 1 underground drilling program at the Company’s high-grade South Mountain Base and Precious Metal Project (“South Mountain” or the “Project”) in southwestern Idaho, U.S.A. Notably, the results from Hole SM19-014 represent the deepest mineralized intersections on the property, and the DMEA zone remains open at depth (See Figures 1 & 2).

From this latest batch of results, Hole SM19-014 has delivered intersections exceeding the Company’s initial expectations through returning multiple zones of mineralization in the projected extension of the DMEA zone. These new intersections of mineralization are outside of the current resource area and indicate the potential to significantly expand the existing high-grade mineral resource (See Figure 1). These results also continue to support the high-grade nature of the Project’s polymetallic mineralization and the dominant copper credit in the adjacent Texas Zone of the deposit (Hole SM19-010). Further mineralized zones from additional holes are under geological logging, sampling and analysis.

DRILL HOLE HIGHLIGHTS:

- SM19-007: 12.20 metres grading 18.16% Zinc (“Zn”), 122.6 grams per tonne (“g/t”) Silver (“Ag”), 4.41 g/t Gold (“Au”), 1.55% Lead (“Pb”), and 0.16% Copper (“Cu”)

- SM19-010 Interval 1: 7.21 metres grading 4.37% Zn, 155.2 g/t Ag, 0.13 g/t Au, 0.03% Pb, and 2.07% Cu

- SM19-014 Interval 1: 15.09 metres grading 9.59% Zn, 127.1 g/t Ag, 1.50 g/t Au, 0.69% Pb, and 0.28% Cu

- SM19-014 Interval 2: 5.81 metres grading 4.88% Zn, 76.9 g/t Ag, 2.55 g/t Au, 0.21% Pb, and 0.12% Cu

- SM19-014 Interval 5: 8.29 metres grading 8.11% Zn, 178.7 g/t Ag, 0.48 g/t Au, 0.57% Pb, and 1.73% Cu

Note: ALS Global completed the analytical work with the core samples processed at their preparation facility in Reno, Nevada, U.S.A. All analytical and assay procedures are conducted at the ALS laboratory in North Vancouver, BC. Reported widths are drilled core lengths as true widths are unknown at this time. It is estimated based upon current data that true widths might range between 60-80% of the drilled intersection.

John Wilton, President, CEO and Director of BeMetals stated, “We are very pleased with the results from these drill holes as they reinforce the Company’s delivery of our goals for phase 1 drilling at South Mountain. Specifically, drill hole SM19-014 demonstrates the potential to considerably expand the high-grade zinc and precious metal mineralization at this underground project. The multiple zones (six in total) of predominantly zinc, silver and gold in this hole, represent the deepest intersections of mineralization on the property. Importantly, this indicates that the DMEA zone of mineralization can be significantly extended at depth below the Sonneman underground level. This drill hole was terminated because the drill rig reached its maximum depth limitation.

Hole SM19-010 has returned 7.21 and 10.04 metres at 2.07% and 1.75% copper respectively. These intersections relate to skarn-hosted chalcopyrite copper mineralization in the Texas Zone area drilled from the southeastern end of the Sonneman level. This intersection supports historical underground sampling work that indicates the potential for the Texas Zone to develop into a significant area of high-grade copper and silver mineralization with further drilling.

Hole SM19-007, with a 12.20 metre intersection of 18.16% zinc, 122.6 g/t silver and 4.41 g/t gold from the DMEA zone, above the Sonneman level, illustrates the potential upside in grade for both base and precious metals within the deposit, even exceeding the historical high-grade resource estimate grades.”

PHASE 1 DRILLING AT THE SOUTH MOUNTAIN PROJECT

The principal objectives of the phase 1 work plan at South Mountain was to test for potential extensions of the mineralized zones and confirm the grade distribution of the current polymetallic mineral resource estimate. The Company has now successfully completed the phase 1 program comprised of 20 underground drill holes for a total of approximately 2,250 metres. Geological logging and sampling of additional drill holes are ongoing, and further results will be released when available, before being compiled into designing the phase 2 program for 2020. Table 1 below shows the results received from holes SM19-007, SM19-010 and SM19-014 and Table 2 provides the drill hole co-ordinates, azimuth and dip.

Table 1. Drill Holes SM19-007, SM19-010 and SM19-014: Analytical and Assay Results

| Borehole IDs & Intervals | From (m) |

To (m) |

Core |

Zn % | Ag g/t |

Au g/t |

Pb % | Cu % |

| SM19-007 | 26.97 | 39.17 | 12.20 | 18.16 | 122.6 | 4.41 | 1.55 | 0.16 |

| SM19-010 | ||||||||

| Interval 1 | 24.41 | 31.62 | 7.21 | 4.37 | 155.2 | 0.13 | 0.03 | 2.07 |

| Interval 2 | 53.11 | 63.15 | 10.04 | 0.40 | 135.1 | 0.07 | 0.01 | 1.75 |

| SM19-014 | ||||||||

| Interval 1 | 105.31 | 120.40 | 15.09 | 9.59 | 127.1 | 1.50 | 0.69 | 0.28 |

| Interval 2 | 138.07 | 143.88 | 5.81 | 4.88 | 76.9 | 2.55 | 0.21 | 0.12 |

| Interval 3 | 155.17 | 158.95 | 3.78 | 14.49 | 145.5 | 0.37 | 0.25 | 0.48 |

| Interval 4 | 184.40 | 189.56 | 5.15 | 0.28 | 79.9 | 2.08 | 0.15 | 0.06 |

| Interval 5 | 250.65 | 258.94 | 8.29 | 8.11 | 178.7 | 0.48 | 0.57 | 1.73 |

| Interval 6 | 266.33 | 268.16 | 1.83 | 1.32 | 158.9 | 2.56 | 0.56 | 0.11 |

Note: Reported widths are drilled core lengths as true widths are unknown at this time. It is estimated based upon current data that true widths might range between 60-80% of the drilled intersection. Intervals cut offs are based upon visual contacts of massive sulphide units with no more than 1.75 metres of internal skarn. For SM19-010 a nominal 0.5% copper cut off has been applied to determine the boundaries of the intersections for this skarn hosted mineralization with no more than 1.4m of internal dilution. (Note: See details below in QA/QC section).

These drill holes returned significant intersections of both massive sulphide and skarn styles of mineralization. Important sulphide minerals are pyrrhotite, sphalerite, galena, arsenopyrite and chalcopyrite. During the planned phase 2 campaign at South Mountain, the Company will carry out mineralogy and metallurgical test work studies to confirm historical results.

Drill holes SM19-008 and SM19-12 were designed to test the hanging wall contact of the upper extension to the DMEA and did not return any significant mineralization. Drill holes SM19-009 and SM19-011 targeted southeastern most extensions to the Texas Zone some 130 to 140 metres from the currently nearest accessible drill station. These drill holes did not intersect the planned target zone due to deviation of the holes. Future exploration of the southeastern most Texas Zone mineralization will be designed from drill stations further to the southeast after widening of the existing underground level in this area. SM19-013 intersected skarn units with minor sulphides in the envelope to the significant SM19-014 mineralization.

Figure 1: 3D Perspective View inclined at 20 degrees looking north-north-east, showing locations of rib-sampling, priority target zones, and drill holes SM19-007, SM19-010 and SM19-014

Figure 2: Plan View of the Sonneman & Laxey Levels, South Mountain Deposit, showing locations of rib-sampling, priority target zones, and drill holes SM19-007, SM19-010 and SM19-014

Table 2: Drill Hole Azimuth, Dip and Collar Co-ordinates

| Hole ID | Azimuth Degree |

Dip Degree | End of hole Length (m) |

East (ft.) | North (ft.) | Elevation (ft.) |

| SM19-007 | 313 | 30 | 74.07 | 231,1481 | 393,978 | 6,860 |

| SM19-008 | 050 | 50 | 85.95 | 231,1481 | 393,978 | 6,860 |

| SM19-009 | 110 | 21 | 144.47 | 231,1776 | 393,763 | 6,870 |

| SM19-010 | 150 | -13 | 117.96 | 231,1776 | 393,763 | 6,870 |

| SM19-011 | 128 | 8 | 130.76 | 231,1799 | 393,741 | 6,870 |

| SM19-012 | 003 | 68 | 77.11 | 231,1480 | 393,978 | 6,860 |

| SM19-013 | 210 | -63 | 145.69 | 231,1176 | 394,129 | 6,868 |

| SM19-014 | 210 | -61 | 271.79 | 231,1176 | 394,129 | 6,868 |

QUALITY ASSURANCE AND QUALITY CONTROL PROCEDURES

The project employs a rigorous QC/QA program that includes; blanks, duplicates and appropriate certified standard reference material. All samples are introduced into the sample stream prior to sample handling/crushing to monitor analytical accuracy and precision. The insertion rate for the combined QA/QC samples is 10 percent or more depending upon batch sizes. ALS Global completed the analytical work with the core samples processed at their preparation facility in Reno, Nevada, U.S.A. All analytical and assay procedures are conducted in the ALS facility in North Vancouver, BC. The samples are processed by the following methods as appropriate to determine the grades; Au-AA23-Au 30g fire assay with AA finish, ME-ICP61-33 element four acid digest with ICP-AES finish, ME-OG62-ore grade elements, four acid with ICP-AES finish, Pb-OG62-ore grade Pb, four acid with ICP-AES finish, Zn-OG62-ore grade Zn, four acid digest with ICP-AES finish, Ag-GRA21-Ag 30g fire assay with gravimetric finish.

The technical information in this news release for BeMetals has been reviewed and approved by John Wilton, CGeol FGS, CEO and President of BeMetals, and a “Qualified Person” as defined under National Instrument 43-101.

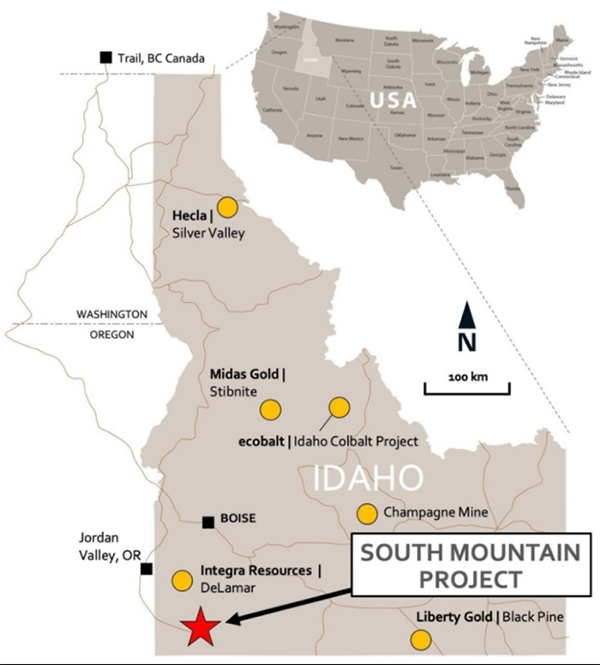

THE SOUTH MOUNTAIN PROJECT

South Mountain is a polymetallic development project focused on high-grade zinc and is located approximately 70 miles southwest of Boise, Idaho (see Figure 3). The Project was intermittently mined from the late 1800s to the late 1960s and its existing underground workings remain intact and well maintained. Historic production at the Project has largely come from high-grade massive sulphide bodies that remain open at depth and along strike. According to historical smelter records, approximately 53,642 tons of mineralized material has been mined to date. These records also indicate average grades; 14.5% Zn, 363.42 g/t Ag, 1.98 g/t Au, 2.4% Pb, and 1.4% Cu were realised. Thunder Mountain Gold Inc. purchased and advanced the project from 2007 through 2019, with expenditures into the project of approximately US$12M. The current mineral resource estimate of the deposit is detailed in Table 3 below and the Company expects to provide a revised mineral resource update following a phase 2 drilling program in 2020.

The Project is largely on and surrounded by private surface land, and as such, the permitting and environmental aspects of the Project are expected to be straightforward. Permits are in place for underground exploration activities and BeMetals does not anticipate significant barriers to any future development at the Project.

Figure 3: Project Location Map

Table 3. NI 43-101 Mineral Resource Statement for the South Mountain Project - April 1, 2019

| Mineral Resources at 6.04% ZnEq Cut-off | |||||||||||||

| Classification | Zinc Equivalent Resource | Contained Metal | |||||||||||

| Short Tons |

ZnEq lbs | ZnEq % | Zn lbs | Zn% | Ag oz. | Ag opt (g/t) |

Au oz. | Au opt (g/t) |

Pb lbs | Pb % | Cu lbs | Cu % | |

| x1000 | x1000 | x1000 | x1000 | x1000 | x1000 | x1000 | |||||||

| Measured | 63.2 | 22,200 | 17.57 | 14,700 | 11.64 | 237 | 3.745 (116 g/t) |

4.0 | 0.063 (1.96 g/t) |

600 | 0.483 | 700 | 0.566 |

| Indicated | 106.7 | 37,800 | 17.72 | 21,500 | 10.08 | 576 | 5.398 (168 g/t) |

7.0 | 0.066 (2.05 g/t) |

2,100 | 0.983 | 1,600 | 0.766 |

| Measured + Indicated |

169.9 | 60,000 | 17.66 | 36,200 | 10.66 | 813 | 4.783 (149 g/t) |

11.0 | 0.065 (2.09 g/t) |

2,700 | 0.797 | 2,300 | 0.692 |

| Inferred | 363.2 | 120,800 | 16.63 | 70,500 | 9.70 | 2,029 | 5.585 (174 g/t) |

16.3 | 0.045 (1.49 g/t) |

8,700 | 1.202 | 5,200 | 0.696 |

- The effective date of the mineral resource estimate is April 1, 2019. The QP for the estimate is Mr. Randall K. Martin of Hard Rock Consulting, LLC, is independent of BeMetals Corp.

- Mineral resources that are not mineral reserves do not have demonstrated economic viability. Inferred mineral resources that are part of the mineral resource for which quantity and grade or quality are estimated on the basis of limited geologic evidence and sampling, which is sufficient to imply but not verify grade or quality and continuity. Inferred mineral resources may not be converted to mineral reserves. It is reasonably expected, though not guaranteed, that the majority of Inferred mineral resources could be upgraded to Indicated mineral resources with continued exploration.

- The mineral resource is reported at an underground mining cutoff of 6.04% Zinc Equivalent (“ZnEq”) within coherent wireframe models. The ZnEq. calculation and cutoff is based on the following assumptions: an Au price of US$1,231/oz., Ag price of US$16.62/oz., Pb price of US$0.93/lb., Zn price of US$1.10/lb. and Cu price of $2.54/lb.; metallurgical recoveries of 75% for Au, 70% for Ag, 87% for Pb, 96% for Zn and 56% for Cu, assumed mining cost of US$70/ton, process costs of US$25/ton, general and administrative costs of US$7.50/ton, smelting and refining costs of US$25/ton. Based on the stated prices and recoveries the ZnEq formula is calculated as follows; ZnEq = (Au grade * 43.71) + (Ag grade * 0.55) + (Pb grade * 0.77) + (Cu grade * 1.35) + (Zn grade).

- Rounding may result in apparent differences when summing tons, grade and contained metal content. Tonnage and grade measurements are in imperial units.

About BeMetals Corp.

BeMetals' founding Directors include Clive Johnson, Roger Richer, Tom Garagan and John Wilton. BeMetals is a new base metals exploration and development company focused on becoming a significant base metal producer through the acquisition of quality exploration, development and potentially production stage projects. The Company is advancing both its early stage, tier one targeted, Pangeni Copper Exploration Project in Zambia, and its advanced high-grade, zinc-silver polymetallic underground exploration at the South Mountain Project in Idaho, USA. The Company’s growth strategy is led by our strong Board, key members of which have an extensive proven record of delivering considerable value in the mining sector through the discovery, construction and operation of mines around the world. The Board, it’s Advisors, and senior management also provide outstanding deal flow of project opportunities to BeMetals based upon their extensive network of contacts in the international minerals business.

On Behalf of BeMetals Corp.

"John Wilton"

John Wilton

President, CEO and Director

For further information about BeMetals please visit our website at www.bemetalscorp.com and sign-up to our email list to receive timely updates, or contact:

Derek Iwanaka

Vice President, Investor Relations & Corporate Development

Telephone: 604-609-6141

Email: diwanaka@bemetalscorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains "forward-looking statements" and “forward looking information” (as defined under applicable securities laws), based on management’s best estimates, assumptions and current expectations. Such statements include but are not limited to, statements with respect to the plans for future exploration and development of the South Mountain and Pangeni projects, and the acquisition of additional base metal projects. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as "expects", "expected", "budgeted", "forecasts" , "anticipates" "plans", "anticipates", "believes", "intends", "estimates", "projects", "aims", "potential", "goal", "objective", "prospective", and similar expressions, or that events or conditions "will", "would", "may", "can", "could" or "should" occur. These statements should not be read as guarantees of future performance or results. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from those expressed or implied by such statements, including but not limited to: the actual results of exploration activities, the availability of financing and/or cash flow to fund the current and future plans and expenditures, the ability of the Company to satisfy the conditions of the option agreements for the South Mountain Project and/or the Pangeni Project, and changes in the world commodity markets or equity markets. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The forward-looking statements and forward looking information are made as of the date hereof and are qualified in their entirety by this cautionary statement. The Company disclaims any obligation to revise or update any such factors or to publicly announce the result of any revisions to any forward-looking statements or forward looking information contained herein to reflect future results, events or developments, except as require by law. Accordingly, readers should not place undue reliance on forward-looking statements and information. Please refer to the Company’s most recent filings under its profile at www.sedar.com for further information respecting the risks affecting the Company and its business.